How my college friends and I turned Beer Night into the TNC – the Thursday Night Consortium (1)

How I lost my morals on the first step (Part 1):

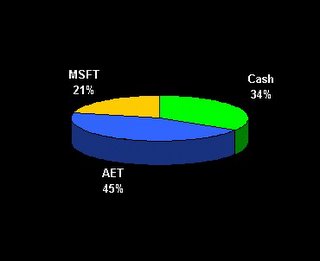

I started this game with the intent of only investing in stocks that would be for the betterment of humanity. That went out the window on my first purchase ($700 for 8 shares of an insurance company, eek). I knew that the company was a safe bet and that they would probably split this year in February. I still felt guilty about abandoning my ideals during step one though.

Three weeks later I finally saved up an additional $500. But, before making a choice I did some serious research. I looked up every “green hedge fund” to see what companies they were interested in. One fund listed Union-Carbine as “an environmentally friendly chemical company.” Holy WTF, Batman! If you don’t know why this is shocking, check out this letter from

Email me if you want specific research details, ‘cause it’s pretty boring and I don’t want to your eyes to glaze over just yet.

Finally I opted for 14 shares of a green-friendly natural gas company (okay, getting better). It was a safe choice. I bought them at the lowest point in what appears to be a pretty regular fluctuation of the share price. The dividends covered most of the commission costs and then I sold them at a profit. I currently have a limit order in place as they go into their next trough.

This was pretty small potatoes stuff and it scratched my investment-itch. Better yet, I’ve got 4% return per month on my choices. But I wasn’t proud of what I ha, and what good are my 8 or 14 votes in a company where there are millions of outstanding shares? None.

To be continued…